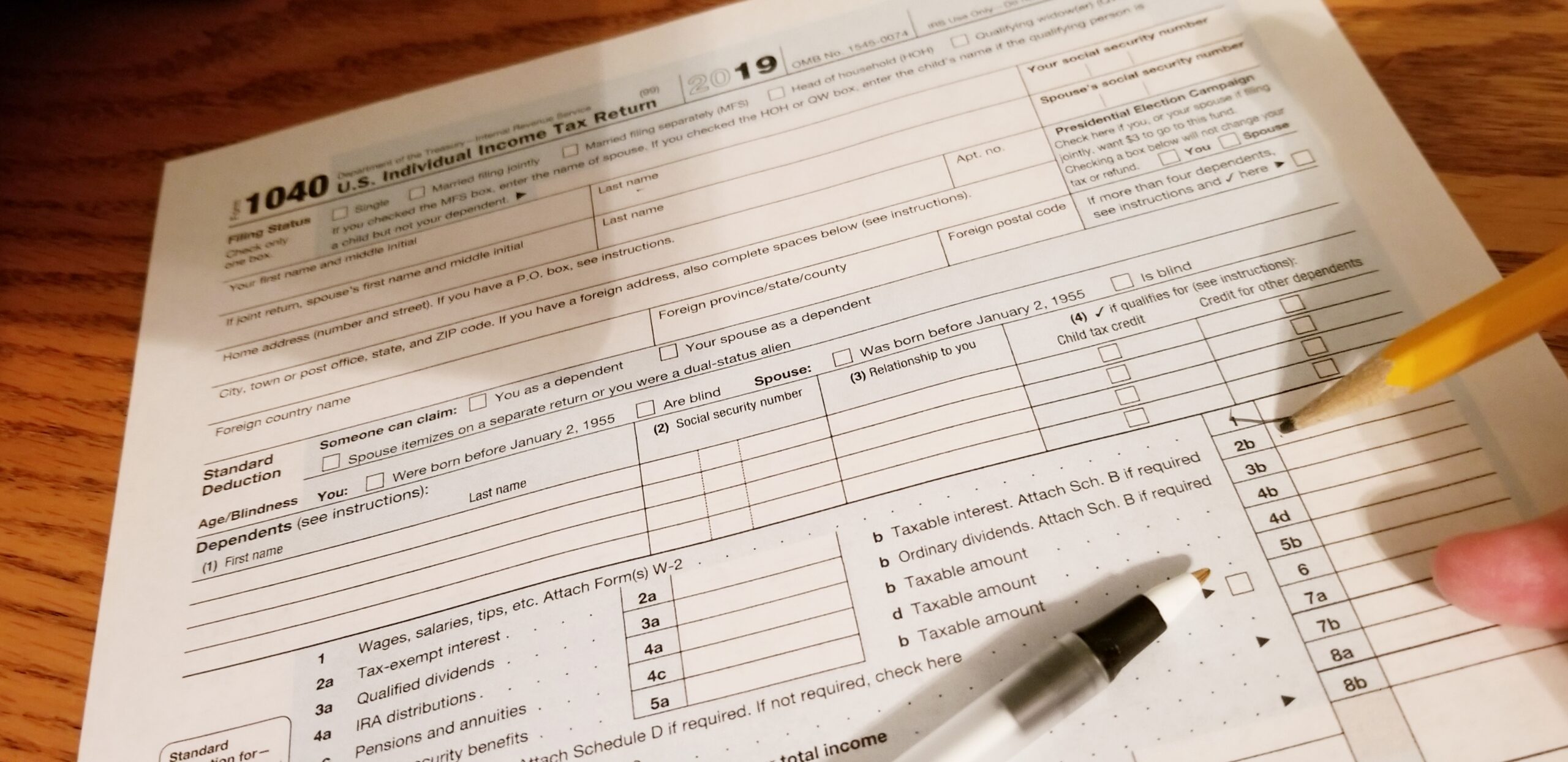

Do you need reliable help in the preparation and filing of personal income tax forms?

Black Ink Industries wide range of personal taxation and tax planning services are geared for individuals and families, small business owners, or those retired or self-employed.

Whether you own your own business or work for others, our tax specialists remain well-versed in all recent federal and state tax laws to ensure optimal financial benefits at income tax time and all year long.

What distinguishes Black Ink Industries tax and financial planning services?

Technologically advanced operating systems, dedication to accuracy, and qualified expertise is now available to taxpayers seeking maximum tax savings and minimal liability. Committed to understanding each client’s financial objectives, Black Ink Industries develops personalized custom tax plans for following an in-depth consultation:

- Comprehensive review and assessment of all tax and related documents

- Rapid electronic filing and prompt refunds

- Tax planning beyond the current taxation period

- Estate and trust planning

- Risk management and the minimization of federal or state income tax audit

- Current and long-range planning

- Retirement planning

- Gift tax planning and reporting

Black Ink Industries provides guidance on a full range of approaches that promote tax savings and improve cash flow; allow Riverside clients to develop and attain their financial goals.

Tax Planning Services

Effective tax planning is necessary throughout the year and is a fundamental component in overall financial security. In addition to preparing your personal income tax return, Black Ink Industries provides strategic solutions that reduce tax burdens and develop tax management plans using the most current incentives available.

Building wealth requires a detailed analysis of your financial records to determine the tax implications of your investments and holdings. By structuring the most appropriate combination of assets within your portfolio, debt is reduced, and income tax returns are optimized.